Quiet the Noise (Listen to the Data)

Below you will find a temperature reading on the market and the risk level on the field.

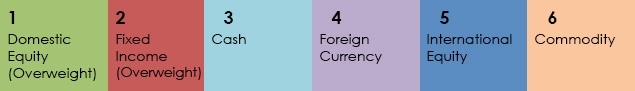

Relative Strength Line Up of the Asset Classes:

Q3 2015 Activity:

- Cash moved UP into the #3 spot

- International Equity moved DOWN from #2 to #5 over the course of the quarter (a move this large is rare in such a short period). ALL PORTFOLIOS are VOID International Equities.

10/1/2015 Status:

- #1 Asset Class: Domestic Equities

- #2 Asset Class: Bonds/Fixed Income

- Market Status: BULL

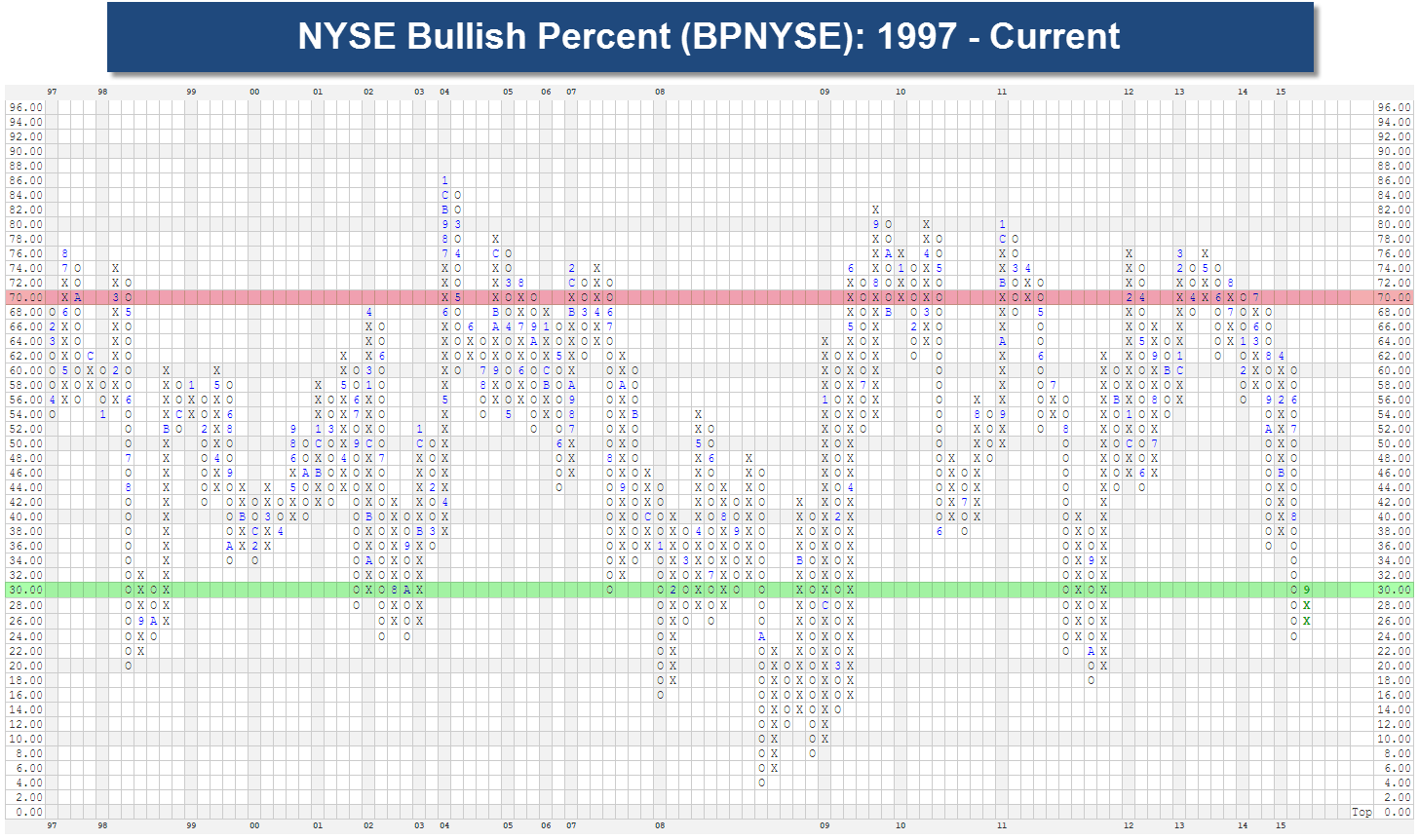

- NYSE Bullish Percent (NYSE BP): DEFENSE @ 26% (below 30% represents low equity risk) down from 51.74% on 7/1/2015. OF NOTE: as of this writing, 10/7/2015, the NYSE BP REVERSED, TODAY, BACK to OFFENSE, at 32%.

Much can be said about the above lineup. Simply put, with only one equity asset class in the top 2 positions, and with more “risk-off” assets moving up the asset scale — Cash, Bonds and Currencies firmly dethroning International Equities (now in the #5 of 6 spots) — we find ourselves in a semi-defensive posture, with our 100% equity clients, for example, invested in bonds and cash, and our typical bond clients holding a higher percentage of bonds and cash than usual.

Yet, as long as Domestic Equities remain in the #1 or #2 spot, we are primed to “make hay while the sun shines.” Clearly a shift to risk-off assets has occurred. If we wake up and find ourselves with NO equity asset classes in the top 2 spots, there will be no “hay making.” All portfolios, for the most part, will be in bonds, cash and whatever occupies the #1 and #2 spots — which ultimately means single-digit growth returns.

Until then, we will remain invested in Domestic Equities and feel confident about old and new positions given the low risk level on the field–26% on the NYSE BP is, statiscally, very low risk (22 occurences since 1952), happening, on average, about every 4 years (see commentary below for elaboration).

The last time we saw levels this low on the NYSE BP was 2011 and the indicator rallied from 18% to 62% in 4 months coupled with a move in the equity markets of approximately 12-14%. The inevitable reversal in the NYSE BP to OFFENSE, occurred TODAY, at 32% and with it will bring greener pastures ahead for portfolio returns.

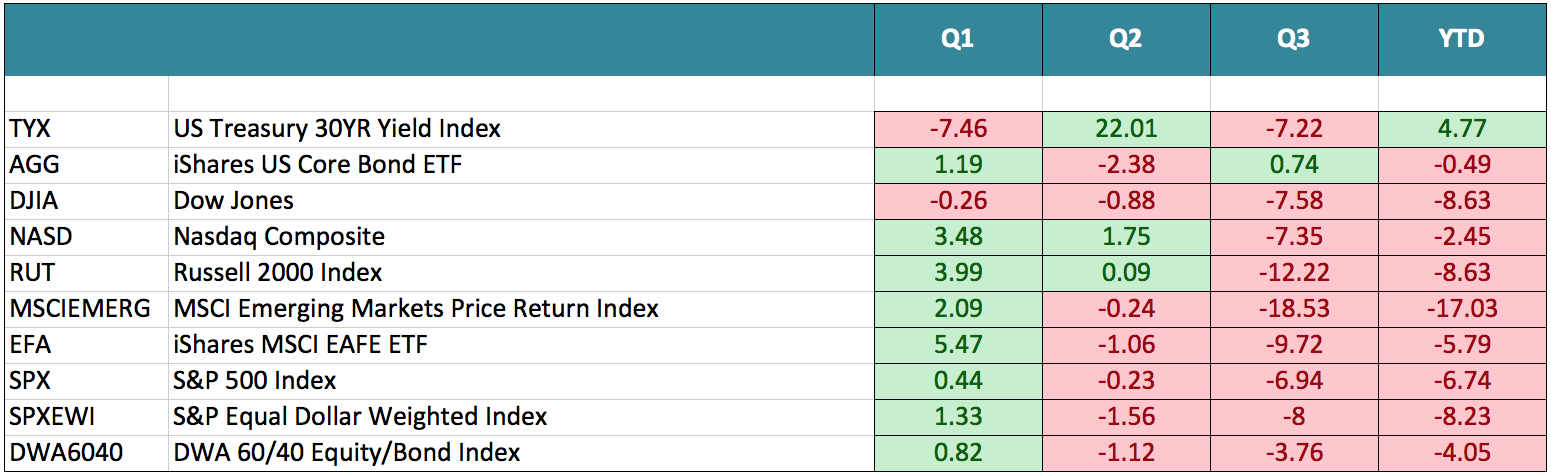

2015 YTD Market Stats:

As you can see below, the only positive mover YTD is the 30-Year Treasury yield, which has gained a mere 4.77% while all other indices are negative YTD.

YTD Performance: 12/31/2014-9/30/2015

The returns for indexes, ETFs, futures, and stocks do not reflect dividends and are based on the last sale for the date requested. Returns for mutual funds do account for distributions. Performance data does not include all transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

Q3 2015 in review and the bottom line:

After hovering near historic highs for months, stocks fell in August on concerns over economic issues in China and other emerging markets. September was marked by continued volatility as investors grappled with uncertainty. Though pullbacks are never pleasant, many analysts had been predicting a correction.

What contributed to market performance last quarter?

Fears about slowing global growth dogged markets for much of the quarter. China, the world’s second-largest economy, took center stage in mid-August when its central bank unexpectedly devalued its currency. Later in the month, markets worldwide plummeted when reports showed that China’s economy may be heading toward a recession. Since then, data releases have underscored that China’s economy is in trouble. Will China slip into a recession? No one knows for sure, but it’s looking increasingly likely.

The Federal Reserve has also added to investor uncertainty as it debates raising interest rates from near-zero lows. Though the Fed has pledged to raise rates soon, concerns about China and the recent market turmoil caused the central bank to hold its current rate levels until October at the earliest.

The September jobs report showed a big miss in job creation, possibly indicating that the labor market is slowing. The economy added just 142,000 jobs in September, and new hires were revised downward to 136,000 in August. Though the unemployment rate remained stable at 5.1%, the labor force participation rate dropped to 62.4%, the lowest rate since October 1977.

While a couple of months of weak hiring isn’t terrible, the numbers are below the 200,000 trend that we’ve seen in recent months, and well short of the 203,000 jobs economists had been expecting. While we don’t want to draw too many conclusions from a single data release, it’s fair to say that months of weak commodities prices, volatile oil, and weak global demand may be taking a toll on U.S. companies. Though Fed Chair Janet Yellen expressed support for raising rates this year, the weak jobs report could cause the Fed to hold off on a rate raise until 2016.

What can we expect in the weeks ahead?

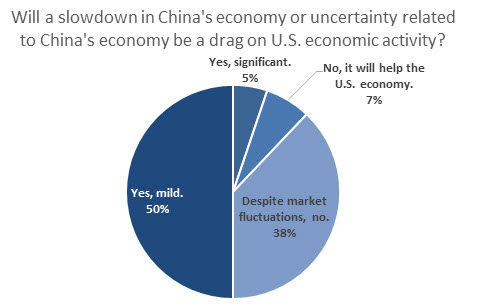

Growth will be on everyone’s minds in the coming weeks and months as analysts look for evidence that global economic worries have reached American shores. Some analysts worry that emerging market woes risk leading the world economy into a slump. A September survey of economists showed that though many are concerned about the effects of China’s slowdown on U.S. growth, most expect the effect to be relatively mild. However, a significant minority expect China’s issues to have no real effect on the economy, despite market turmoil. The U.S. economy may be mostly shielded from the effects of slow global growth because domestic demand drives so much of our economic growth.

In the coming days, earnings reports will give us more information about how U.S. companies fared in the last three months. Though we don’t have a lot to go on yet, we have positive expectations after a tough September. The October Federal Reserve Open Market Committee will also be closely watched by analysts to determine whether the Fed is likely to raise rates this year.

Bottom line: We can expect more volatility in the coming weeks as investors digest data and wait for more certainty. While pullbacks and turmoil are often stressful, we are always on the lookout for opportunities and ways to help our clients pursue success amid the uncertainty. If you have questions about your portfolio or how you are positioned for today’s markets, please give our office a call. We are always happy to answer questions and offer a professional perspective.

Various Sources; Infinite Asset Management Q4 Newsletter

What is the NYSE Bullish Percent telling us–What is the Risk on the “field”?

The recent volatility signaled a flurry of mid-quarter alerts — more than ever before. Following is what I think are the most crucial of the updates, as they address two areas of key interest among investors:

- Current risk level of equity markets: LOW

- Statistically/historically, what might we expect this quarter and beyond?

The NYSE BP is our risk indicator. Below 30% is considered, statistically dating back to the 1950s, low-risk zone, and above 70% is high-risk zone. THIS is a concept that does not resonate with many of today’s investors attempting to navigate volatile markets. If you are one of those investors, take a look back to 1997 and see what can happen when the NYSE BP reverses out of the green zone:

The notable aspect of last month’s NYSE BP move to Offense (find the green X’s to the far right, above) is that it came after falling below 30% (refresher: this means less than 30% of stocks on the NYSE are on buy/positive signals — purely a price performance measure — and very low statistically), which historically is a good field position for owning equities.

Historical Look at NYSE BP Below 30%

Levels this low have happened only 22 times over the past 60 years — meaning, this field position comes along roughly once every three to four years.

Historically, it has been a common occurrence to see a re-test after the initial reversal up, and we are now re-testing. Of the 22 occurrences below 30%, the NYSE BP has seen a re-test of the low 12 times, or roughly 58%. This is what we just experienced — we are now re-testing the low established on 8/28/2015.

Of optimistic note, however, of those prior 12 times — NOW 13 — only four were “failed” re-tests that actually produced a new low on the NYSE BP (this last happened in 2011). Note below, however, this failed re-test in October 2011 produced double-digit returns after the NYSE BP reversed at 18% and quickly rallied to 72% by February 2012.

While we cannot predict the future, we can look at previous trips to 30% for the NYSE BP.

Worth repeating from the last Market ALERT:

No matter what your appetite for risk, you ARE invested in cash and bonds — more so than your July portfolio held. Our most aggressive allocations now contain bonds and cash given the current Asset Scale (below).

This is where you are supposed to breathe a sigh of relief and take respite in the fact that we don’t believe in lazy, buy-and-hold allocations that tell you to ride out storms with unfounded direction.

On the contrary. When an asset class falls below cash, as International Equities have, we sell International Equities. When Bonds take the #2 Asset Class position, and you are an aggressive investor, alas, you will own Bonds. These are the rules. This is GO time.

Remaining disciplined to our time-tested strategy of honoring the risk that the Asset Scale presents us has been easy for 3 to 4 years — until December of 2014. It got even harder for investors in August — and harder again on Monday.

Herein lies the perfect example of what defines us as tactical asset managers versus market timers. Why remain in stocks at a correction like this you may ask? Abiding by our time-tested rules is the answer. While our tactical methodology and adherence to these rules may not offer out performance in the short- or even medium-term, we are confident in the long-term results.

More succinctly: We are still invested in stocks because we are still in a Bull Market and Domestic Equities still remain in the #1 position on the Asset Scale. That is why we still own stocks.

Portfolio Changes

Notable Portfolio changes:

- VOID International Equities

- Master Limited Partnership (MLP) exposure minimized to 2-6%

I wrote last quarter that the biggest portfolio lag of my 19 years managing investments had occurred over the past 12 months, and while that lag continued into Q3 2015, the overall market’s worst quarterly returns since 2011, I feel I have yet again made notable changes to the portfolios and feel confident that with the elimination of the 2 major culprits of 2015’s under performance (beyond that of general market losses), the Long/Short Model, and the MLP Model, that portfolios have greener pastures ahead.

Specifically, for those of you invested with Income Growth Advisory’s (IGA) MLP Model, I have terminated those MLP positions and the management of IGA. Our portfolio rules call for minimizing further losses with that manager, and given that I suspect the timing of the termination of IGA would be deleterious, all clients with prior MLP exposure were reinvested in an MLP position that represents 50% of prior MLP exposure. Thankfully, the Alerian MLP ETF, AMLP, has returned over 14% since we acquired it on 9/30. This position will continue to be an integral part of a diversified bond hybrid strategy that will, with time, add growth, and interest rate and inflation protection beyond that of traditional bond positions.

Informing my clients as to what is NOT working with your portfolios is of more importance to me than sharing what is working — you deserve to know the proverbial Good, Bad and the Ugly — to overuse a phrase, herein. But more importantly, I am confident that the Bad and the Ugly have been eliminated from your portfolios for the balance of 2015 and beyond. Full transparency is what Liberated Investors demand and deserve.

Many of you have been patient with the relative strength versus the buy-the-market methodology — buying the market being the strategy to which we do NOT subscribe—and in time, with the elimination of the Long/Short and the former MLP strategy, you will see why sticking with our relative strength methodology is the best way to earn your portfolio returns, and more importantly, avoid our next Bear Market.

Please contact us with your questions and to schedule a review of your performance, today.

Resources, Resources, Resources!

Check out our new website and Resources page at Alphavest.com and explore the many means with which we are trying to empower all investors.

A snapshot of what’s there

Morningstar™ Fee Analysis. Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying.

Free Consultations with Cokie. Those who have used this offer have found it beneficial and have been pleased with the value 15 minutes of their time provides. We use this resource to offer investors a no-pressure opportunity to assess whether Alphavest is a good fit. This is a great place to send those that you think may need our services. Thank you for your referrals and consideration!

FINRA Advisor Background check. FINRA reports that only a small percentage of investors check their advisor’s record before making a switch. We run background checks on our employees, our childcare providers — why not run one, it’s FREE — on the person who manages your money? Rest assured our record is spotless (click here for Cokie’s U4). The important feature of the report is that it will indicate “NO DISCLOSURES,” which means no fraud or investor complaints.

Rules Quarterly

Due to the lengthy nature of this quarter’s newsletter, we have opted to skip “Rules Quarterly” this installment.

If you really want one of my unofficial rules, however, how about this one from renowned investor Sir John Templeton: “Buy when blood is in the streets.”

Subscribe to Cokie’s Blog for more frequent updates on Markets and Matters….

Most of my blogs are less than 200 words (except this quarter! FWEH!) — short and sweet! I post as a means of quick and efficient communication with you, my clients. Your feedback is very important to me. THANK YOU for letting me know what you like reading … and what you don’t!

Q3 Most Read Blogs:

- A Nickel Ain’t Worth A Dime Anymore

- Ladies: Put Yourselves First This Labor Day; Women the great multi-taskers

- Mid-Quarter Update: ALERT! Market Correction?—Quiet the Noise!

- Timing the Fed hike or China’s next shoe to drop? Market timers beware.

Join the Liberated Investor Movement TODAY!

We launched the Liberated Investor Movement in an effort to educate investors on how to break free from being held hostage by “Big Brokerage.”

The Liberated Investor Tool Kit exposes five areas of the investment management industry where the deck is stacked against investors and offers simple and direct advice:

- Excessive Fees and What Can Be Done About Them

- The Myth of Buy and Hold

- The Emotion Behind Market Timing

- Industry Conflicts of Interest

- How to Hire An Advisor That’s On Your Side

Download the Tool Kit today and share with your Facebook community and friends and family!

The best way to refer us? Tell others to download the FREE The Liberated Investor Tool Kit: