Special Update:Quarterly Report from Wealth E&P

This Week on Wall Street

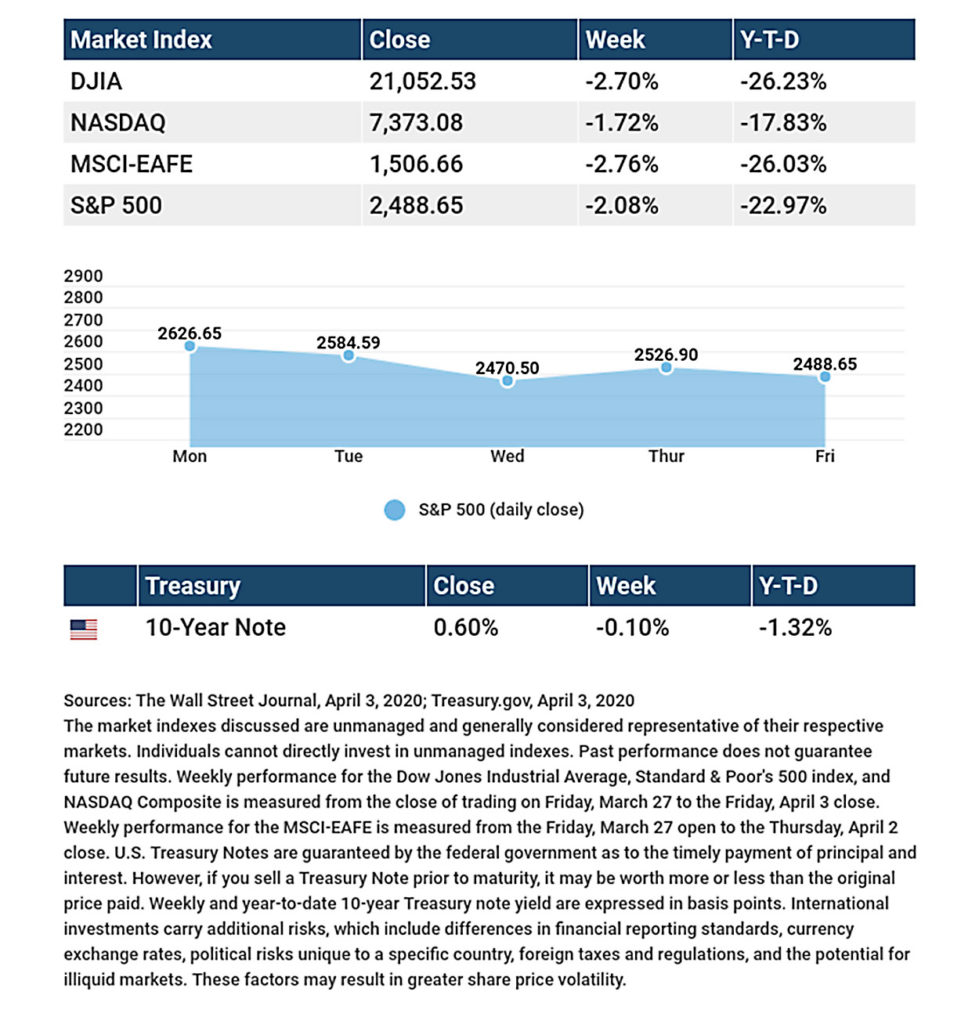

Modest declines in stock prices this week masked the volatile inter- and intraday price swings as investors digested poor economic data and a warning from the president that the worst days of the COVID-19 pandemic may still lie ahead. The Dow Jones Industrial Average slipped 2.70%, while the Standard & Poor’s 500 dropped 2.08%. The Nasdaq Composite Index declined 1.72%. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 2.76%.[1][2][3]

The Quarter in Brief

The spread of COVID-19 sent stocks tumbling in the first quarter as health and economic costs of the pandemic began to mount. Stocks remained under pressure, despite the Federal Reserve’s lowering of short-term interest rates and the government’s stimulus efforts through the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act. The DJIA sank 23.2% and the S&P 500 dropped 20% on the quarter. The COVID-19-related volatility in the market has left all but a handful of sectors in a prolonged period of uncertainty. With millions of Americans staying at home in an effort to “flatten the curve” of COVID-19’s impact on people, businesses are coping with closing for the duration, altering practices, or facing staffing issues.[4]

Oil Turbulence

The oil market dominated the commodities headlines during the first quarter. The failure of Russia to join Saudi Arabia in supporting lower oil production targets left Saudi Arabia fuming and responding with an announcement of its intention to raise oil output. Oil prices plummeted on the news, contributing to the stock market’s woes. While lower oil prices represent a boon to consumers in the form of lower gasoline prices and a relief to companies with high energy consumption (e.g., airlines, chemical), they also pose a risk to the American energy industry.

Should low oil prices persist, it may lead to lower capital expenditures, labor force reductions, and troubles in the credit markets as less-capitalized companies struggle to meet their debt obligations. As the quarter came to a close, there was some speculation that President Trump would take a larger role in working with Russia and Saudi Arabia on production targets.

What’s Next

It is difficult to see, in the middle of the COVID-19 epidemic, exactly what the full impact will be. Suffice it to say, the cost in human terms has been staggering so far and seems certain to affect at least part of the coming quarter. As people and businesses adapt to extended periods of quarantine, the only thing that seems clear is that no aspect of American life will be unchanged. CARES Act stimulus checks are on the way for millions of Americans. The Federal Reserve has lowered interest rates. Further measures are being considered at the state and federal levels. The only two things that seem truly certain are that action is being taken and that we’ll all breathe a sigh of relief once this crisis subsides.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: JOLTS (Job Openings and Labor Turnover) Survey.

Wednesday: FOMC (Federal Open Market Committee) Minutes.

Thursday: Jobless Claims for Unemployment.

Friday: Consumer Price Index.

Source: Econoday, April 3, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Delta Airlines (DAL)

Thursday: Rite-Aid (RAD)

Friday: First Republic Bank (FRC)

Source: Zacks, April 3, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[1] The Wall Street Journal, April 3, 2020. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[2] The Wall Street Journal, April 3, 2020. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[3] The Wall Street Journal, April 3, 2020.

[4] CNN.com, March 31, 2020.

[5] DinnerAtTheZoo.com, April 3, 2020.

[6] IRS.gov, May 20, 2019.

[7] Golf Distillery, April 3, 2020.

[8] Success.com, April 3, 2020.

[9] GreenAmerica.org, April 3, 2020.